Best Bitcoin-Backed Loan Rates in January 2026: Compare Terms & LTV

Ledn has over $10 billion in loan originations since 2018 and counting!

Looking to borrow against your Bitcoin in 2025? In this guide you’ll find today’s best Bitcoin loan rates, information on how BTC-backed loans work, and tips to find the most cost-effective option.

Current Bitcoin loan rates (January 2026)

Below is a comparison of the latest BTC loan rates, terms, and collateral management practices from the top platforms.

📌 Rates change regularly. Check with each provider for live updates.

What is a Bitcoin-backed loan?

A Bitcoin loan lets you borrow money using your BTC as collateral without selling it.

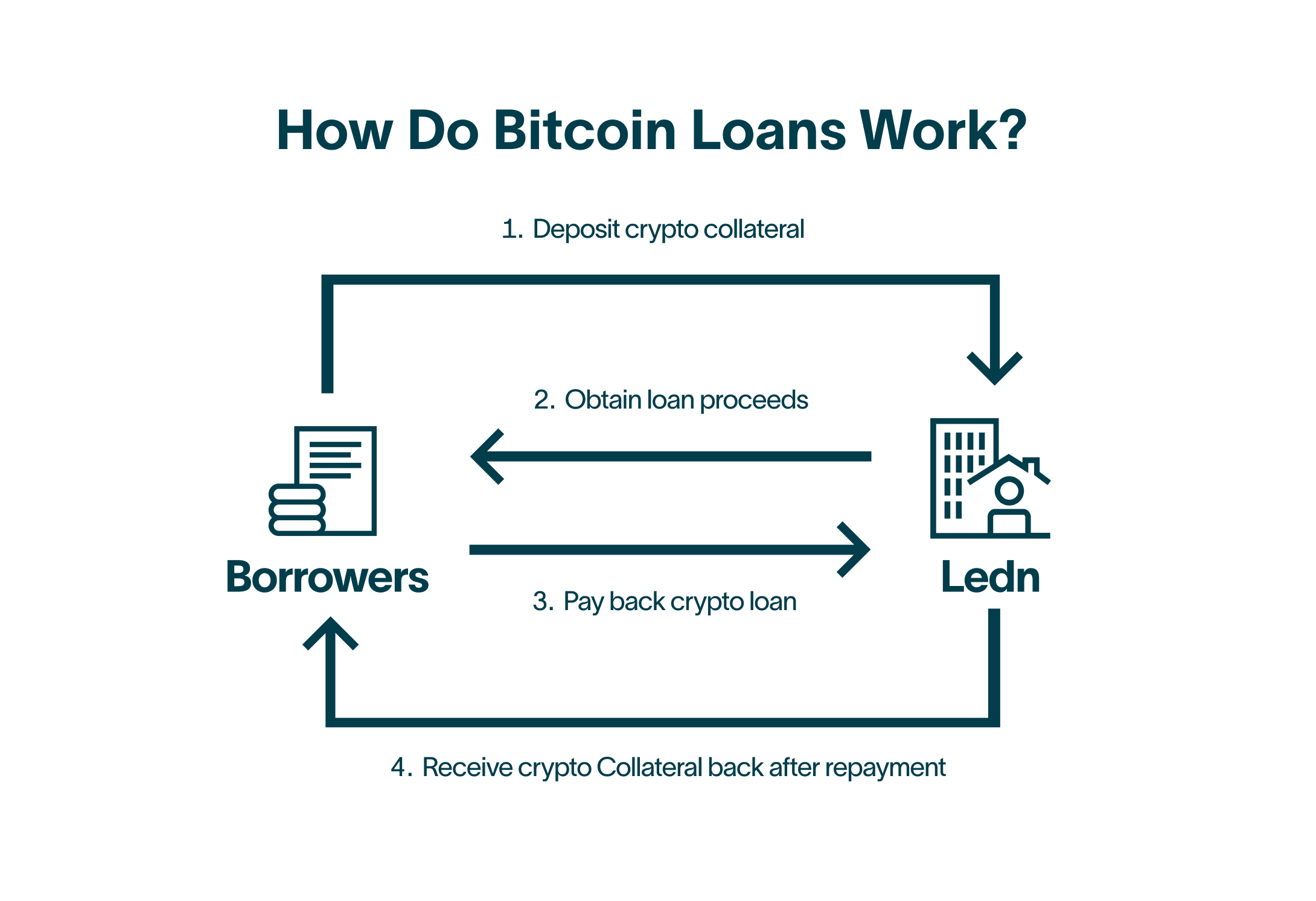

Here’s how it works:

- Deposit Bitcoin with a lending platform

- Receive a loan in fiat (e.g. USD) or stablecoins

- Repay the loan + interest to get your BTC back

- If you don’t repay, the platform may liquidate your collateral

Read more: What can you use a Bitcoin loan for?

How to get the best Bitcoin loan rates in 2025

Bitcoin loan rates vary widely depending on the platform, loan terms, collateral requirements, and market conditions. Here’s how to make an informed, cost-effective borrowing decision in 2025:

1. Compare loan platforms and lending models

Start by reviewing multiple platforms. Look at not just the annual percentage rate, but how the platform operates:

Centralised vs decentralised. Platforms like Ledn offer streamlined, custodial services. Aave and Morpho (used by Coinbase) operate on-chain via smart contracts.

Collateral requirements. Some platforms allow high loan-to-value (LTV) ratios (up to 90%), but these come with higher liquidation risk.

Collateral management. Platforms that lend out your collateral may offer lower rates. Others keep it in cold storage and charge more.

Read more: 15 Best Crypto Loan Platforms in 2025

2. Choose a term that fits your goals

Loan duration directly affects rates and risk:

- Short-term loans (e.g. 30 or 60 days) typically offer lower rates but require quick repayment.

- Open-term or flexible loans give you more breathing room but may come with higher interest or compounding fees.

- Fixed-term loans (e.g. 1 year) can lock in rates — useful in volatile markets.

3. Monitor real-time market conditions

Interest rates on some platforms (like Aave or Coinbase via Morpho) adjust dynamically based on crypto market conditions and liquidity. Timing your loan when demand is low and BTC volatility is reduced can help you access better rates.

Use platform dashboards or rate tracking tools to stay updated.

4. Understand platform-specific perks and risks

Some platforms offer tools or features that may reduce your overall cost:

- Ledn: No credit checks, minimum loan size of $1,000, monthly Proof-of-Reserves, and custody model for collateral management.

- Nexo: Loyalty rewards and lower rates if you hold NEXO tokens.

- YouHodler: High LTV ratios and short-term loans for rapid liquidity, but high rates and collateral risk.

Read platform reviews, check user feedback, and confirm whether early repayment is allowed without penalties.

5. Avoid hidden fees and check total loan costs

Don’t focus only on the advertised APR. Make sure to factor in:

- Origination or withdrawal fees

- Maintenance or account fees

- Liquidation penalties (if collateral drops in value)

- Currency conversion costs (if borrowing in stablecoins or fiat)

A lower headline rate isn’t always the cheapest once fees are added.

Read more: Bitcoin-backed Loans vs Traditional Loans: Everything you need to know

What affects your rate?

Your borrowing rate depends on several variables, including:

Loan amount

Higher loan amounts may attract higher risk premiums, especially if they represent a large portion of the platform’s available liquidity. Some platforms may offer volume-based discounts, but this isn’t always the case.

Loan duration

Shorter loan terms usually mean lower rates, as there's less exposure to price volatility and market risk. Longer terms may cost more due to the added risk over time.

Bitcoin price

If BTC is highly volatile, platforms may adjust rates to account for the increased risk of margin calls or forced liquidation. A falling BTC price can also trigger collateral top-up requirements, making the loan more expensive to maintain.

Platform liquidity

Well-capitalised platforms with strong lending demand and available stablecoins can offer more competitive rates. If liquidity is tight, borrowing costs typically increase.

Rehypothecation

Some platforms re-lend your collateral to generate yield, which can subsidise lower interest rates. However, this introduces additional counterparty risk.

The case for Bitcoin-backed loans

A Bitcoin-backed loan lets you access cash without selling your BTC. You might be looking to invest, cover expenses, or unlock liquidity. In all of these cases, a Bitcoin-backed loan is a flexible and efficient alternative to traditional borrowing.

Here are a few reasons to consider a Bitcoin-backed loan:

1. Fast access to funds

Bitcoin-backed loans are designed for speed. You don’t need to wait for lengthy applications or bank approvals. With Ledn, loan terms are one year but they can be prepaid at any time without penalties..

Read more: How Bitcoin Whales Leverage Their Holdings Without Selling

2. No credit checks

Bitcoin-backed loans don’t rely on your credit history. Your Bitcoin acts as collateral, which secures the loan. This makes them accessible to borrowers who may not qualify for traditional credit.

3. Lower interest rates

Because Bitcoin-backed loans are secured, they tend to offer better rates than unsecured options like payday loans or credit cards. The collateral reduces risk for the lender, which helps lower your cost of borrowing.

Some platforms also lower rates by generating yield on collateral. This is called rehypothecation. It involves lending out the collateral to institutional borrowers, which can help subsidise the interest you pay.

4. Global access

You can apply for a Bitcoin-backed loan from anywhere with an internet connection. There is no need for a local bank account. This is especially helpful for people in underbanked or underserved regions. However, keep in mind that Bitcoin-backed loans may not be available in all regions.

5. More privacy

Unlike traditional loans, Bitcoin-backed loans typically require minimal personal information. The main requirement is your collateral. This helps protect your privacy and reduces the amount of data you need to share. However, those borrowing with Bitcoin as collateral usually need to complete identity verification (KYC) and satisfy certain eligibility criteria.

6. Keep your Bitcoin

A Bitcoin-backed loan lets you unlock the value of your BTC without selling it. This means you can keep your position in the market, potentially without triggering a taxable event, and still access liquidity when you need it.

What type of Bitcoin loan is right for you?

Ledn has originated over $9 billion in loans since 2018. It continues to lead the market in transparency and speed.

It offers two loan options:

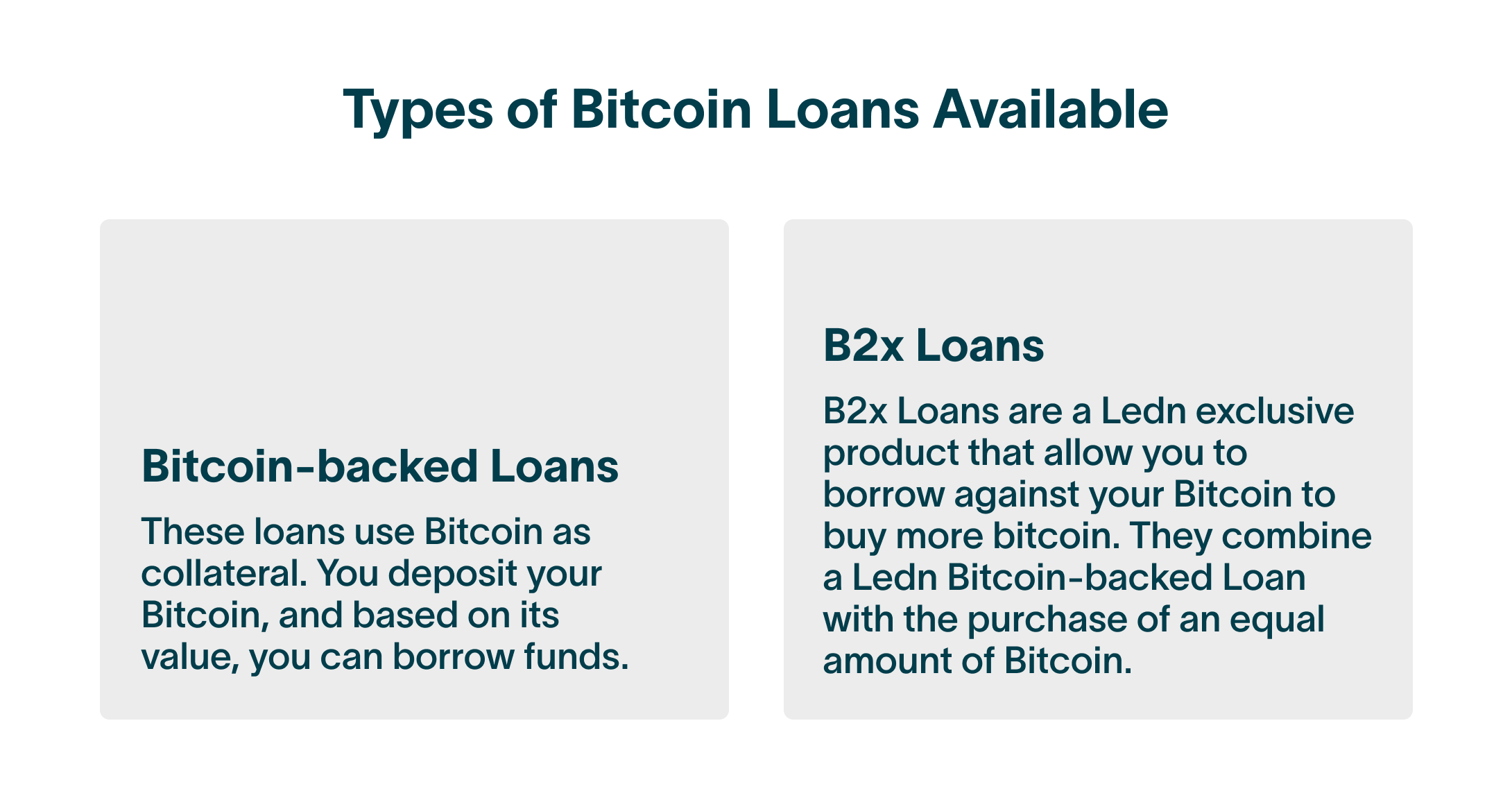

Bitcoin-backed Loan

This is a straightforward way to unlock the value of your Bitcoin without selling it. You deposit BTC as collateral and receive a loan in USD, your local currency or USDC. These loans are

- Ideal for accessing cash while keeping your Bitcoin exposure

- No credit checks or selling required

- Use funds for anything, from bills to new investments

You keep your BTC position and repay the loan on your schedule.

B2X Loan

B2X is a Ledn-exclusive product for those looking to increase their Bitcoin holdings.

- Borrow against your existing Bitcoin

- Use the loan to automatically buy an equal amount of BTC

- When you repay the loan, both your original and newly purchased Bitcoin are returned to you

This is designed for people who want to increase exposure without adding new capital. However, this leverage strategy also carries significant risks, as price drops could lead to collateral liquidation or losses.

Ledn clients benefit from built-in safeguards

Ledn’s platform is designed to protect your Bitcoin while giving you access to liquidity. Every feature is built with client security, transparency, and control in mind.

Here’s how Ledn helps you protect your assets:

Real-time loan monitoring

Your account dashboard shows your current loan-to-value (LTV) ratio so you can monitor risk at a glance.

Early margin call alerts

If your LTV approaches a critical level, you’ll receive timely alerts so you have time to add collateral or repay part of the loan.

Auto-top-up

You can enable auto-top-up to automatically move available BTC into your loan if your LTV climbs too high. This reduces the chance of liquidation during sudden market drops.

No surprise liquidations

Ledn gives you every opportunity to act before your collateral is at risk. During a recent 32% BTC price decline, Ledn had zero loan liquidations because clients were informed early and supported by platform safeguards.

Transparent platform management

You can track how assets are managed through monthly Open Book Reports and monitor your own position in real time.

Need liquidity? A Bitcoin-backed loan could be an option.

Disclaimer

This article is sponsored by 21 Technologies Inc. and/or its subsidiaries (“Ledn”) and is for general information, discussion, or educational purposes only and is not to be construed or relied upon as constituting legal, financial, investment, accounting, tax, estate-planning, or other professional advice or recommendation. Please read Ledn’s full Risk Disclosure Statement and Disclaimers.

The experts opinions:

CTA Block 1

Ledn was created by people who believe in Bitcoin’s power to revolutionise finance and build wealth reliably.

CTA ButtonCTA Block 2

Ledn was created by people who believe in Bitcoin’s power to revolutionise finance and build wealth reliably.

CTA ButtonCTA Block 3

Ledn was created by people who believe in Bitcoin’s power to revolutionise finance and build wealth reliably.

CTA ButtonCTA Block 4

Ledn was created by people who believe in Bitcoin’s power to revolutionise finance and build wealth reliably.

CTA Button